November 14, 2022

How to Receive Payments from Abroad in Nigeria

Viki Johnson

Article, Finance, Freelancing

Need to get money from a client, friend, or family member who lives abroad? Read this article.

Need to receive money from someone who lives abroad? Read this article.

First, let me categorically state (yes, it’s sarcasm) that it’s best to receive money from abroad in foreign currency and not in naira — for obvious reasons. You can make exchanges with local money changers at very good rates. So ensure that your sender is sending in their currency and not yours.

Now that we’re on the same page about this, let’s talk about the best inter-country money transfer methods that favor people living in Nigeria. You and me. Leggo!

1. Cash Pickup

This method is probably the quickest to set up because it doesn’t really require you to set up anything. All you have to do is send your name and mobile number to the sender and then go get your money at the bank. Yes, that’s the downside — you have to get out of your chair and go to the bank. Life is hard like that.

Cash pickup works through a couple of service options like Sendwave and WorldRemit. Your sender would need to sign up on the website or mobile app of one of these services in order to send money to you. They can also send money to you via the Western Union or United Nations.

The pickup process is pretty standard across these services. You may incur a $10 – $15 charge on payments below $500. On the bright side, your sender can get a few free payments as a first-time user on Sendwave and Worldremit

Receiving Your Money via Cash Pickup

You’ll be notified via SMS when your cash is available for pickup, so make sure you give the sender your active mobile number. This message will contain two codes (one alphanumeric and one numeric) along with a list of banks to receive your cash from. P.S. You are not required to open an account with any of these banks to get your money from them.

Once at the bank, you will be required to fill out a form that looks like the one below. The document’s quality isn’t great though, thanks to the bank it was issued at.

Be prepared to fill in the following required text fields before going to the bank:

• Your identification details (BVN and a government-issued ID will be required).

• The sender’s name.

• The sender’s address (you can just input their city/country) and

• Your mobile number will also be required.

Also, ensure that the name you give to the sender is the exact same name on your government-issued ID, or else you will be sent back home. e.g Victory Johnson and Victoria Johnson are not the same people. So ensure you spell out your name clearly to the sender.

Your money will be given to you in cash, in the sender’s currency (USD, GBP, Euro etc). You can find a local money changer to exchange your foreign currency for naira at a good rate. Or deposit it in your domiciliary account if you have one. Exchanging money at the bank will leave you in utter disappointment, so avoid it.

2. Payoneer

Receiving money via a Payoneer account is the most suitable option for freelancers. However, you need a domiciliary account to get the best out of this service. I’ll tell you why in just a bit.

Payoneer is a digital platform that allows freelancers to receive payments from foreign countries by providing them with foreign currency bank accounts. It is most convenient if you regularly receive payments from registered businesses abroad. You get bank accounts in the major currencies (Dollar, Euro, and Pound) to which your clients can send money. You can also apply for other foreign currency bank accounts within your Payoneer account. You can then withdraw the money into your naira bank account (not a good option) or into a domiciliary account of the same currency.

You may want to withdraw into a domiciliary account and not your naira bank account because Payoneer uses standard currency exchange rates. Which means you get much less for every dollar (or whatever currency) than you would if you used local money changers. (Okay, I’m really hyping these guys at this point. What would we do without them?).

Anyways, you will be charged $10 for withdrawals below $500 into your domiciliary account of the same currency. Even with this deduction, it’s still a much better option than naira withdrawals.

Note that you can only receive USD payments from a registered business in the United States through ACH transfers. Don’t worry about what this means, your sender knows what it means.

If your sender is not a registered business or cannot make ACH transfers, then go for the cash pickup option instead.

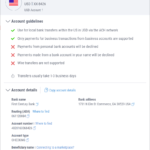

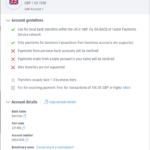

To receive money via Payoneer, you will need to send the account details of the currency account—provided by Payoneer—that you wish to receive your payment. The bank account details will include: an account number, bank name, account holder name, and other country-specific bank details that you can find under the Get Paid → Receiving Accounts section of your Payoneer account. Ensure to note the guidelines for each type of account.

You will receive an email from Payoneer once you’re credited, and then you can make a withdrawal request.

If you use my referral link to open a free Payoneer account, you’ll get a $25 bonus once you reach a certain threshold. I know, I do the most for y’all. No need to thank me, I get a bonus too. But if you insist, you’re welcome.

3. Domiciliary Account

I already talked about getting a domiciliary account in this article: **How to Make International Payments Online from Nigeria**. Dom accounts are great for saving in foreign currency and making online payments. They can also be used to receive payments. However, I do not recommend receiving money directly into your dom account from a foreign account. This is because inter-country transfer charges are ridiculously high. We are talking up to $25 for a $100 transfer sometimes. Avoid it. But you need a dom account to make the best use of Payoneer, hence why I included it in the list.

Learn more about domiciliary accounts here.

My Recommendation for Freelancers Receiving Payments from Foreign Countries

My recommendation should be pretty obvious by now. But I will still state it clearly (LOL) so that you will not say I didn’t tell you.

Use a combination of a domiciliary account and a Payoneer account for receiving payments from foreign companies or businesses. If you’re already making passive income from platforms like Amazon KDP,- and withdrawing directly from Payoneer to your naira bank account, you will almost double your profits if you open a domiciliary account to withdraw into.

For payments (or gifts or others) from individuals, I advise that you go the ‘’cash pickup’’ route.

If you found this article informative, then kindly share it with someone that might need it. I’d also love to get your feedback in the comments below. I always respond to comments.

PS: If you’re wondering why/how I know so much about this topic (I know you’re not, but I hope you are). It’s because I’m a Nigerian freelancer who provides services to clients living in other countries. Now that I have shared this bit of information with you (even though you did not ask for it), you might want to consider staying longer on my blog, and reading this article:

How I Got Started with Freelancing (A Step-by-Step Guide You Can Follow).

Thanks!

Post Tags :

Article, Finance, Freelancing

1 thought on “How to Receive Payments from Abroad in Nigeria”

I really liked your site.